Undocumented immigrants in the United States contributed nearly $100 billion in taxes in 2022, according to a report by the Institute on Taxation and Economic Policy.

A common argument for limiting immigration revolves around the financial burden on the U.S. government. However, undocumented immigrants contribute approximately 26% of their income in taxes, mirroring the median taxpayer, as highlighted by a report from the Institute on Taxation and Economic Policy (ITEP), a left-leaning think tank.

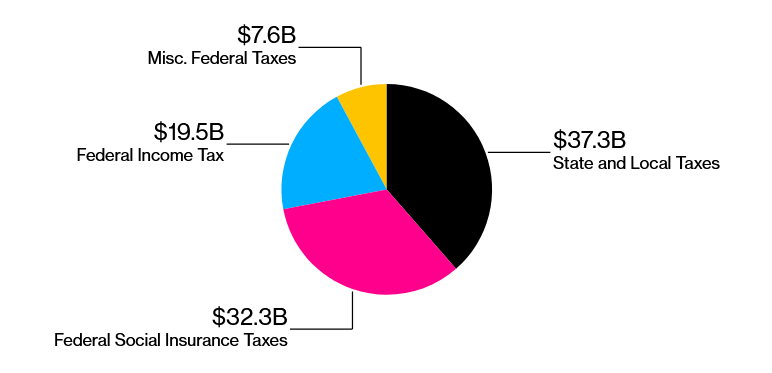

In 2022, undocumented immigrants in U.S. collectively paid $96.7 billion in taxes, averaging around $9,000 per person. Despite generally lower incomes, they are less likely to claim refunds or earn tax-preferred income, thus contributing significantly to the national coffers.

The report notes that a significant portion of the tax dollars collected from undocumented immigrants supports programs from which they are largely excluded. Specifically, $26 billion went to Social Security and $6 billion to Medicare.

The undocumented immigrant population is concentrated in a few key states, with over half residing in California, Texas, Florida and New York. Six states, including New York and California, received over $1 billion in tax revenue from their undocumented residents.

As of 2022, nearly 11 million undocumented immigrants lived in the country.